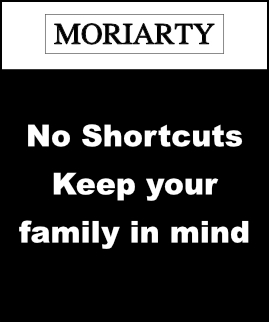

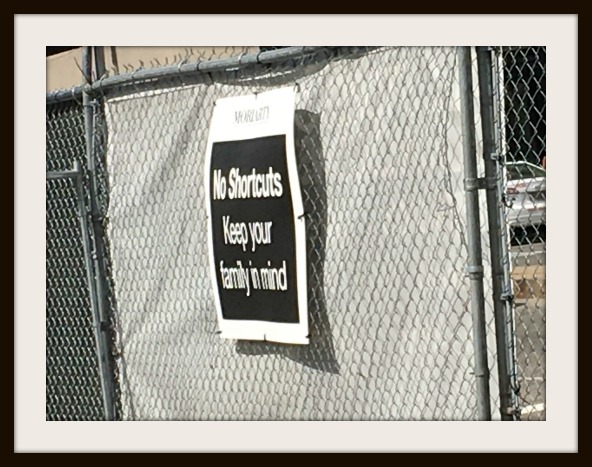

No Short Cut Sign

At the Copley Mall construction site is this sign:

I don't know who at the construction company thought of it, but it's certainly a different type of motivation sign: "No Shortcuts Keep Your Family in Mind"

Actual sign seen in early 2016.

On June 7th, the Copley Mall entrance is scheduled to reopen. Some interesting information:

- Closed for Construction on March 6, 2016

- Total Construction Days: 458 days ( or 316 calendar days excluding Weekends and Holidays)

- Inial Cost of the Project: $9.2 million

- Number of opening delays: 4 ( Dec 2016, January 2017, March 2017, June 2017)

- Average number of commuters that pass through the doors:

I am glad to see the entrance reopening. Hopefully, the escalator doesn't break down as much as it did before.

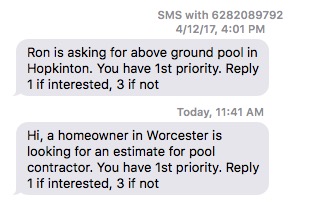

PermalinkMystery Text Messages

Recently I have been getting lots of mystery text messages like these:

- Ron is asking for above ground pool in Hopkinton. You have 1st priority. Reply 1 if interested, 3 if not

- Hi, a homeowner in Brockton is looking for an estimate for the inground pool. You have 1st priority. Reply 1 if interested, 3 if not

- Hi, a homeowner in Tyngsboro wants to get a quote for pool contractor. You have 1st priority. Reply 1 if interested, 3 if not

According to a post in RemoteCentral.com, it turns out the text messages is from gosmith.com.

gosmith.com is a service that matches homeowners with projects with professionals that can handle the project. I am not sure how my phone number go into their database. I think they purchased a cellphone contractor list and just sending out text messages. I certainly wouldn't have signed up for their service, and I never received emails confirming that I am listed as a contractor.

PermalinkTips for having a Take Your Son/Daughter to Work day.

This was the third year that I help organize the "Take your Son/Daughter to work day." It a great program that helps your children understand what their parents do at work all day. This is sponsored in part by the Take you Son and Daughter to Work foundation.

Planning

About a month before the day, we sent out invitations to parents to let them know of the event. We asked their age and if they had any special allergies. We followed up with an additional email a week before the event.

The most common feed back that I got was "why was this during a school time?" Wouldn't it make more sense to do it during school vacation week?

From the foundation:

Take Our Daughters And Sons To Work(R) Day is organized during the school year so girls and boys can take what they learn in workplaces on Thursday and apply it to the classroom on Friday. By involving whole communities--schools, girls and boys, parents, workplaces, and mentors--the program helps young people make connections between what they learn in school and their future goals.

Activities

Here are some of the activities that we had planned:

Younger Kids

- Color in the Company Logo

- Where are we on the city map? What are we near?

- Word Matching (Name to Logo) - How well do you know your logos?

- Create your Dream Job - What do you want to be when you grow up and why?

- What would your Work Desk look like?

- iPiggiBank - "Allowance is serious kid business"

- A-Z Office Wordlist - A scavenger hunt to find things that matches a letter of the alphabet.

Older Kids

- What do you think our logo should look like?

- How do you think we do to help other companies?

- Brainstorming Activity: What is your Dream Job?

- What skills will you need to do your dream job?

- Job Matching Quiz - Match the job title with the picture.

- "The Future is Me" - Write the headline of something you wish to accomplish someday

- iPiggiBank - "Allowance is serious kid business"

- A-Z Office Wordlist - A scavenger hunt to find things that matches a letter of the alphabet.

Some Lessons Learned

- Anything younger than 7 is non-productivity. Kids are just running around. Keep activities short and interesting.

- Have lots of snacks for the kids and their parents. There are plenty of healthy allergy free snacks

- I saw some business having matching color shirts for the kids. This was a great idea.

- Enlist people that were teachers as volunteers.

- We had a Parents Panel that was useful for the kids to learn what their parents do to help the business.

- We asked kids to bring in their favorite toy for a show and tell.

- When kids arrived we made them make there own name tags

- Some companies split up the age groups. We didn't have enough kids to do that, so we tried activities that everyone would enjoy

- If your building has security in the lobby, check with them on the procedure for bringing kids to the office.

- Part of the building was having a fire drill. We made sure that the kids were always in an area where a drill wasn't going to happen.

- If you have water cups in the kitchen, make sure that things are reachable.

- Paper Airplane activity was a big hit as kids worked hard to build a paper airplane that would fly the furthest.

- The final activity of the day was to have the kids plan for next year event. It was a fun way for the volunteers to see what the kids liked the most.

Zig Ziglar

One of my favorite motivational speakers is Zig Ziglar. He had a way to deliver a message in a very positive way.

One of the things that he frequently talks about is "Automobile University." Where you use the downtime in your commute to listen to inspirational podcast or CDs.

Remembering Zig Ziglar

If you haven't heard of any of Zig Ziglar speeches, check out his podcast on iTunes.

Zig Ziglar died on November 28, 2012. His Tom Ziglar is keeping his message alive. Visit Ziglar.com to learn more about him and events that are coming to your area.

Favorite Quotes

- "Set a goal that makes you want to jump out of bed in the morning." - Zig Ziglar

- "If Plan A doesn't work, there are 25 more letters." - Zig Ziglar

- "You need a plan to build a house. To build a life, it is even more important to have a plan or goal." - Zig Ziglar

- "Happy people don't have the best of everything. They make the best of everything." - Zig Ziglar

- "Don't be distracted by criticism. Remember- the only taste of success some people have is when they take a bite out of you." - Zig Ziglar

- "Be helpful. When you see a person without a smile, give him yours." - Zig Ziglar

- "Lack of direction, not lack of time, is the problem. We all have twenty-four hour days." -Zig Ziglar

Being Productive

Zig Ziglar was all about personal productivity. He's "Day before Vacation" speech is correct. As we tend to get a lot of things done when there is a goal with a deadline.

There are many ways to get productive at the office and selfdevelopmentsecrets.com has some great tips. There's a great article called "How To Be More Productive In Your Workplace (And Everywhere Else)."

PermalinkCommunity Events Calendars

The Benefits of Seeking Out Local Events in Your Area

If you've ever browsed through your local newspaper, checked out your city's website, or even watched the local television channel, you may see a community events calendar. A community events calendar is a great way to find out what's going on your area, but many people don't take up the opportunities or don't even know the events exist.

Here are some benefits to seeking out local events and why you should pay closer attention to a community events calendars:

Promoting Family Togetherness

If you have children, you may be running low on ideas on how to spend time together as a family. One child wants to play with a friend, and another wants to spend a Saturday playing video games. It's tempting to give in, but you may be missing out on a lot of fun activities.

Depending on where you live, a majority of community events are most likely family friendly. Whether it's an outdoor festival or a kids-centered event at your local museum, community events can help you spend more time together as a family.

Meeting New People

Even if you live in a smaller town, there's a good chance that you don't know most of the people in town. Unlike 30 or 40 years ago, not have close connections with your community, let alone your neighbors is a common occurrence. Why? We're all busy, and many of us spend the day talking to people; the last thing that some people want to do is talk to more people.

If you're hesitant to reach out to perfect strangers, think again. Making the effort to attend a community event and make connections with new people can strengthen your trust in others and build lasting relationships.

Helps You to Think Beyond Yourself

While there's a variety of fun things to do, when you look at a community events calendar, don't forget to check out an opportunity to help others, such as volunteering in your community or fundraising for a family in need.

Living in a "me" society, it's easy to forget about helping others. So whether you offer a helping hand at your local animal shelter or make a meal at the local food kitchen, you're thinking about others and enriching your life with one-of-a-kind experiences.

Spend Less Money, Have More Fun

Another plus to attending a community event is that many are free to the public. Rather than dropping more than $20 at a movie theater, why not check out a movie night at the park? If donations are "appreciated," spend that $20 on giving back to the community.

Invite your friends, introduce yourself to a neighbor that you've been meaning to welcome to the neighborhood. Spend less money and have more fun in your community.

Become an Active Member of Your Community

The more time you spend out in your community, the more likely that you'll want to get involved and stay involved. Maybe you'll even run for office or join the school board. Find things in the community that make you happy and proud. Try to make things better and continue to help make your town or city a better place.

PermalinkHow Safe Are Kids on Buses?

Our children are the most precious thing we have. Children are the future, of course, but they're also the present. Children bring joy, love, and countless other varieties of goodness to lives of everyone they meet, every day.

And yet, each day we as a society agree to ship our children to and from school in lunky, rusting buses with no seat belts. Buses are efficient, sure, and most of us can remember a time when we ourselves went to school via bus. But how safe are school buses, really? Let's take a look at a few of the dangers posed each day to our kids on their rides to school.

Road Safety

When a child is in a bus, that child is on the road. Even if buses were the safest form of transport around, they would still be only as safe as the roads on which they ride. Poorly cared for roads are dangerous.

If your child rides the bus to school, you might want to check out the roads that he or she is taking. If you see something that looks unsafe, report it to your local government. And if things look good, you'll be able to relax with the knowledge that your kids are free of danger.

Driver Competence

Every bus needs a driver. And when it comes to picking that driver, a bus company can't always afford to be particular. Laws regarding who can and can't drive a bus vary from place to place, but many places have shockingly low standards. You wouldn't let some college student you don't know drive your car, so why would you be okay letting a young stranger drive an entire bus full of children twice a day?

If you're a parent, there are a few things you can do to ensure your children's drivers are good. For starters, you could walk to your kids to their stop and introduce yourself to the driver. If you're concerned with what you see, you could get involved with local groups to advocate for an increased required age for bus drivers.

Danger from Strangers

The good thing about a bus is that it's public and full of people. The bad thing is that your child needs to stand outside and wait for it. In order to keep your children safe while waiting for the school bus, you can try a few things. First, you can make sure they get there soon before the bus arrives, making sure there's not much waiting time. Second, you can educate your kids on stranger safety and appropriate behavior. Third, you can make sure the bus stop is within eyeshot of your house, allowing you to keep an eye on your loved one for the entirety of the wait.

Bus Safety is for Everyone

Luckily, serious bus crashes are relatively rare. In all likelihood, your children will arrive to school and to your house without an incident. Nonetheless, accidents do occur, and as a parent, you need to keep your eye on potential dangers. Make sure your roads are up to code, the drivers are competent, and your children are not left at their stops for long periods of time. You'll be glad you did.

PermalinkBest Open Office Design

The "Open Office" concept seems to be very popular office layout. No more large cubical walls, or executive offices.

I am not a big fan since I don't like being distracted by seeing people moving around the office.

However, this type of open office concept is something that I would certainly consider:

This is from Freshwater Software company office in Boulder, Colorado. Great use of open office space!

PermalinkTravel Considerations For Disabled Individuals

Most do not stop to think about their daily tasks, and ease of accessibility when traveling outside of the home. On weekends, we may travel to shopping centers, gyms, churches, and other organizations where we can easily get out of the car and walk into. We have the comfort and accessibility to get into the car, drive where we need to go, complete our daily tasks, and travel back home. Depending upon what the activity is, it may take a few minutes, or several hours if it's a longer task to handle.

Do we stop to consider the accessibility options available to families with a disability? Have we thought about some of the challenges that other families might face when enjoying a day outside of the home while caring for a child with a disability? There are a few things we should consider when we are out and about this weekend, and ways we can be more considerate of others with special needs. Here are a few things to think about:

Traveling

For some disabled individuals, a wheelchair or motorized scooter may be required to transport themselves from place to place. With this in mind, it's important to consider how these individuals are able to transport themselves from place to place. Since most average cars are not equipped with options such as ramps and devices that lower platforms to the ground, it makes traveling difficult unless specialized equipment has been installed within the family vehicle.

Most city transportation options have the ability to accommodate those with special needs, allowing them to travel around town with more ease. However, it's important to consider the location of bus or transit stops in relation to the home of the special needs individual. Not to mention, the amount of time waiting for a bus or transit service to pick up an individual. It's not as easy for special needs children to hop into a car and get to where they need to go.

Travel Companion

Most individuals with special needs do not have the means to operate a vehicle by themselves. Even if they were to take public transportation to get to where they need to go, the chances that they are able to travel without the assistance of another individual is very slim. As a result, traveling and getting out and about can sometimes be difficult because of the busy schedules of the caregiver. Planning a trip ahead and ensuring the caregiver has a suitable amount of time to assist the special needs child is a requirement in order to plan a successful trip out.

While Out

After the caregiver has assisted the special needs child with getting out and about, there are additional obstacles that must be considered. The location of the store, event, or activity can play a big factor when considering the safety of the special needs individual. Traveling in an area with a high amount of traffic can easily become unmanageable and dangerous. As a result, avoiding public facilities where large amounts of people or cars are is usually avoided.

Most public places feature accessible options for getting into and exiting the building. Ramps can be of big assistance when pushing a scooter or wheelchair. However, areas with steep inclines, bumps, or narrow areas pose a big challenge for someone in a wheelchair. It may be nearly impossible to travel through these areas, and even harder to travel into buildings that have even a few minimal steps.

What Can Society Do?

As you can imagine, special needs children face many obstacles when they are traveling outside of the home. It requires the practice, patience, and love of his or her caregiver to ensure they are safe and remain safe outside of the home. For the average individual, we should respect and remember these challenges when we come into contact with an individual with special needs. Ensure you are moving to the side to allow for extra space can be a big help when you see someone in a wheelchair. Additionally, offering assistance to caregivers who may be struggling to push a wheelchair can help. A lending hand can always help and will be greatly appreciated by the caregiver. Furthermore, one of the most important things we can do as a society is shown respect, and a genuine smile when we see a special needs individual out. A simple smile and compassion can make a big impact on the individual's day, as well as the caregivers. Consider spreading a smile this weekend when you are outside of the home!

PermalinkAre Truck Inspections Enough?

As a motorist, you probably take multiple commutes across your city or town each and every day. In fact, most individuals spend nearly eighteen thousand minutes per year commuting within their cars. This equates to twelve straight days that Americans average each year in their cars! With all of this time spent on the roads, it becomes more than important to make sure that we are remaining safe while traveling to our destinations.

We can discuss some of the most typical areas- like distracted driving and drunk driving. However, there are particular areas that should be evaluated more thoroughly that may be overlooked by the average driver. These areas include other larger-scale automobiles and trucks. Commuting with, beside, and around them can always become an obstacle even for the most seasoned driver. But, what are truck drivers and the local government officials doing to keep us safe while traveling with larger big rigs?

A typical truck inspection

Truck inspection stations can be seen along highways and roadways across the United States. For drivers, inspection stations may be a burden to commonly travel through and stop. It puts a halt on the driver's time progress being made while commuting, however enforcing these stops and ensuring they are enforced to all truck drivers is essential for every motorist on the roads.

Typical truck inspections include tire pressure checks, engine visual checks, brake inspections, and any overall areas that appear as a potential threat to other motorists. It's up to the truck companies to ensure these inspections are enforced and that all drivers are abiding by the processes set forth by the government.

Weigh Stations

Weigh stations are most important in areas where the elevation increases, like mountainous areas. Traveling down steep inclines can put a lot of strain on the brake systems of trucks, so ensuring trucks are following proper weight guidelines can help prevent brake malfunction in the event of an emergency.

Furthermore, weigh stations are enforced to reduce overloading of trucks, which can damage our roadways and infrastructure systems. Excessive amounts of weight not only cause potholes and damaged asphalt, but they also can raise concerns for other motorists traveling around trucks. In the event a truck needs to make a quick turn, or dodge another motorist, trucks carrying a lot of weight can cause a detrimental outcome when involved in an accident. As a result, weigh stations are heavily enforced among truck drivers, and can provide hefty fines if they are broken.

What motorists should watch for

When traveling down a busy street or highway, it's important to remember the obstacles that truck drivers face while commuting. It's difficult for them to see other vehicles passing or around them because of the numerous blind spots that are a result of their height above ground. Additionally, they are carrying a lot of weight, so maneuvering quickly can easily become difficult in comparison to a typical driver in a smaller car. Furthermore, cars should give ample space to truckers as it may be more difficult to make turns and fit into roadways or bridges that are tighter in space. As much time as the typical American spends motoring the roadways, remaining safe as well as helping a truck driver to make a more successful, safer route to their destination can make all the difference.

PermalinkTalking To Teens

The Dreaded Drunk Driving Discussion

Talking to your young ones and teens can sometimes be a challenge. Initiating conversations related to things like drunk driving, distracted driving, and even the typical talks about growing up through puberty can sometimes be obstacles that we drag out. It's never a topic anyone wants to discuss, but in order to parent our young ones into successful, positive thinking individuals, we have to have these types of conversations.

Drunk driving can be one of the hardest to talk about because it's a gray area where some teens don't seriously think about. Most of the time, the teenage mindset automatically thinks it's is invincible. It's easy for them to think that a drunk driving accident could never, and will never affect them. Unfortunately, this is not always the case. That's why it's extremely important that parents take the proper steps to talk about the dangers early on.

There are a few ways that parents can start the conversation and make strides to develop a meaningful lesson.

Give Them Examples

Depending on where your live might determine how many examples you can actually provide. For families in more urban areas, it's nearly impossible that a news story has not taken the headlines of your local network, covering a story on distracted driving. Share these stories with your teens, and every time an accident makes the headlines, make sure you are reinforcing this with your teen.

Another great way would be to share personal stories or eyewitness accounts you have had with drunk driving. Share an experience you may have had growing up, or explain any accidents you may have witnessed. Provide details and locations for the occurrences.

Give Them Statistics

There are plenty of resources online that can help with this approach to the conversation. For example, Kraft Law has developed a heat map that outlines some of the locations throughout Texas where drunk and drugged driving accidents have to take place. Additionally, the guide provides the number of drugged driving accidents that have taken place throughout the state over the past several years, in comparison to drunk driving accidents. There are many other resources developed by local and state governments that help to outline some of the drunk driving statistics that may be experienced in your region as well.Give Them Support

One of the most overlooked areas that parents forget about when it comes to drunk driving is offering support. In the event that your teen has had a drink or two when they were not supposed to, offer them support. Don't allow your teen to feel as though they cannot call home if a mistake has been made. Offer them support and ensure they are aware that they can call and ask for a ride home if they need to. The same concept goes for a friend who may be in charge of driving your son or daughter home. Make sure they know that they can give you a ring before they get in the car with someone who has been consuming any alcoholic beverages.Your Duties As A Parent

As a parent, you have a moral and emotional obligation to keep your teens safe in all aspects of life. Drunk driving is not an area that should be taken lightly, or looked over. Make sure you are setting up a plan and taking one of the approaches outlined above to show your teens how dangerous drunk driving can be. Most importantly, let them know that you are available if they need to talk to you, or need to make a phone call home if they are stuck in a dangerous situation. PermalinkAbout

Are you looking for new and innovative ways to improve your business? Look no further! In these blog series, we'll be sharing some interesting tips and tricks that can help take your business to the next level. From marketing strategies to productivity hacks, we've got you covered. So, let's dive in and explore some of the most effective ways to grow and succeed in the world of business.

Check out all the blog posts.

Blog Schedule

| Wednesday | Veed |

| Thursday | Business |

| Friday | Macintosh |

| Saturday | Internet Tools |

| Sunday | Open Topic |

| Monday | Media Monday |

| Tuesday | QA |

Other Posts

- Cost of Keeping Your 5W Plugged In

- iOS Screenshot on Google Photos

- What Do Different Colors Mean

- 30 Ice Breaker Questions

- Credit Card at Air Machines

- Dark Social: Understanding and Harnessing the Power of Private Social Sharing

- Rodney Dangerfield

- Daily Planner - Utilizing Strategies from the Art of War

- The Sleep Makeover: Transforming Your Sleep Environment for Success

- Basement Paint

- Winter Lawn Care

- Common Web Design Mistakes Small Businesses Make

- The DR Plateau: Why Your Domain Rating Stagnates and How to Break Through

- Advice for Getting By While Searching for Work and in Recovery

- Great Popcorn