KMAN KUSTOM KRAPPER

Unusual Business at Ocean Edge Golf course

Back in 2014, while playing golf at the Ocean Edge Golf Resort, I saw the following unusual display at the 17th hole:

Sign Next to the Toilet

My name is John Kelliher, Also known as K-MAN. I’ve recently retired after 40 years as a CFO and CPA. My summer house overlooks the 17th tee box. I’ve been playing golf at Ocean Edge for 29 years. As I thought about the next chapter in my life, a FANTASTIC idea as born. There could be a great future in Kustom toilets. As I conducted research & surveyed many Ocen Edge friends & owners, I confirmed there is a market for Kustom toilets. In my case, I’m very proud of my Irish heritage. I’m also a Boston College alum and I LOVE to play golf. So I Kustomized my own

== *: KRAPPER :** ==

I’ve confirmed that there are many like me who after a Koffee & Kruller from Ferretti's would like to settle into the Konfort of a Kustom Krapper for their morning Konstitutional.If you would like a free Konsultation to discuss your hobbies, interests, profession and how to incorporate them into your very own KMAN KUSTOM KRAPPER call or email me.

Pricing & References @ KmanKrappers.com

Creative Marketing

John had a creative way to market an unusual service. I don't know how many people contacted John, but it certainly caught people's attention that day. In the picture, you can see the golf club is being used to flush the toilet.

I am glad I had my phone and took a picture of the display because I didn't see it again the following summer.

No Longer in Business

The KmanKrappers.com domain isn't working anymore. Sadly it looks like John Kelliher died on August 5, 2018. I don't know John, but I still remember that Kustom Krapper.

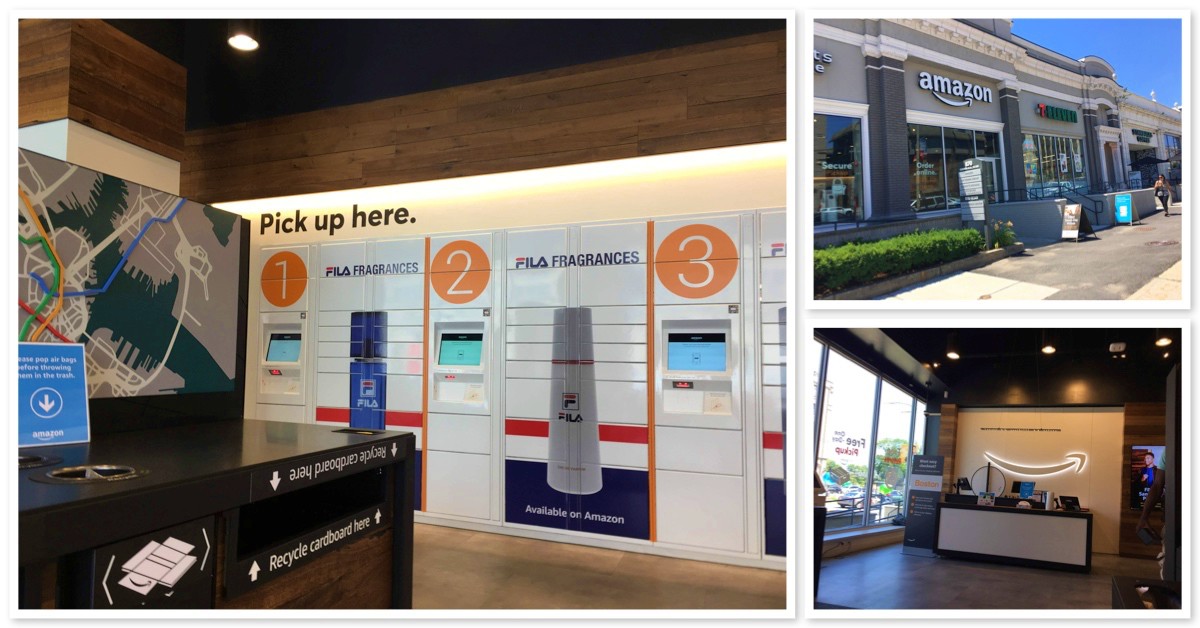

PermalinkAmazon@Boston

General information about Amazon@Boston

Last week I had my Amazon Prime shipped to a drop/pick up the destination in Boston. This was my first experience with Amazon@Boston.

Amazon@Boston is where you can have packages shipped, even get same-day pickup on some items.

Six Things I Learned about Amazon@Boston

- This is an Amazon storefront. I thought it would be lockers inside 7-11. Was surprised to see Amazon sign on the front.

- You have three days to pick up your packages otherwise the items get returned.

- From downtown Boston, the best transportation is the Green "B" line. It's about a 1/2 block walk from the Boston University West stop. This is not a normal stop, so you should hit the notification before arriving at Boston University West.

- You can return packages here. They have boxes and envelopes available for free. You get same day credit for all returns.

- To get your package, you have to click on a link in the Amazon app and wait for Amazon to place your packages in one of the lockers. Takes about 2-minutes to get the packages ready for pick-up. Best to activate as soon as you get off the Green line. Once ready, the app will let you know which locker to go to and scan the QR code.

- There are tools to help open up boxes and envelopes. I decided to open my packages to make it easier to carry on the train.

Common Car Maintenance Solved DIY Style

Four Key areas to pay attention to.

Whether you are male or female, there are several complexities behind car issues. For the average motorist, issues that come about from your automobile might be a burden that can be overwhelming to handle. It's a common myth that automotive repair shops tend to tack on extra unnecessary expenses when taking a car into the shop. If you aren't knowledgeable about cars and how they work, this can be a troubling process. It can be difficult to decipher whether or not the issues that are being discussed are legitimate or not.

It might be a good idea to pick up the phone and call your closest friend who is handy with vehicle repairs. For others, reaching out to close relatives or siblings who have some car knowledge might be another option to ensure they aren't getting ripped off at the shop.

However, there are several ways you can avoid the process of not knowing the verbiage or lingo behind mechanics who are working on your vehicle. You can conduct a few vehicles preventative maintenance routines from the comfort of your own home.

Oil Change

Conducting your own oil change is one of the most overlooked car maintenance tasks. If you have ever taken your car to the shop for this type of job, you know that it usually does not take very long for a mechanic to change this out. If you have space in your garage or driveway, you can easily jack your car up (be careful doing this) with car jacks. Once the car is cooled off completely, use a wrench to remove the oil plug. Place a pan under your vehicle so the oil can dispense into this area. Once drained cap off the oil reservoir and add in fresh oil. Make sure you are adding oil from under the hood and using the dipstick to measure the proper amount that's dispensed. You can ensure the proper oil type is purchased for your vehicle by consulting employees at the automotive shop, or by finding this information in your cars manual.

Tire Rotation

Another easy car maintenance routine is rotating your tires. If you have jacks available from changing your oil, you can do this in a breeze. Ensure both axles are jacked up before removing tires. You can purchase a tree-style wrench at your local auto shop that has various size sockets if you aren't sure which size is right for your car. Start by removing the front driver's tire. Place it, along with the lugnuts to the side. Next, remove the rear passenger tire. Once it's been removed, install it back into the place where the drivers front tire was installed. Likewise, install the previous front driver's side tire where the rear passenger tire was previously installed. Similarly, repeat this same process for the front passenger tire placement with the rear driver tire placement. In 20-30 minutes you should have successfully rotated your tires, at no cost to your wallet!

Wiper Blade Change

This is one of the easiest car maintenance processes. Visit your local automotive shop or some big-box retailers. Most will have a book that informs customers which size wiper blade is correct for their vehicle. Purchase two for the front windshield. Depending upon your model type will determine if you need a rear-window blade or not. Once you are home, remove the previous wiper via snaps located on the wiper blade arm. If you are unsure, your new blades will have instructions on this. Within 10-15 minutes you will have new wiper blades without having to hire a mechanic.

Other Problematic Signs

Remember, if you have many signs or issues with your vehicle, it might be wise to conduct additional research. There are several models of vehicles that are classified as lemon's because of multiple repairs, or recalls that are placed on the vehicle. Check out your state laws to see if your vehicle is deemed a lemon before spending more money on expensive repairs.

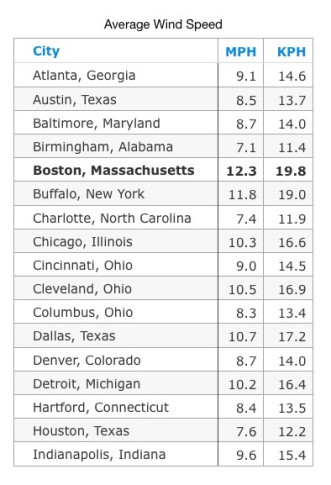

PermalinkAmericas Windiest City

Boston has some very windy days

Boston is America’s Windiest City

Did you know that the Windiest city in the United States is the City of Boston?

This chart shows the average speed in a year duration:

As you can see Boston beats Chicago - which has the name as "America's Windiest City"

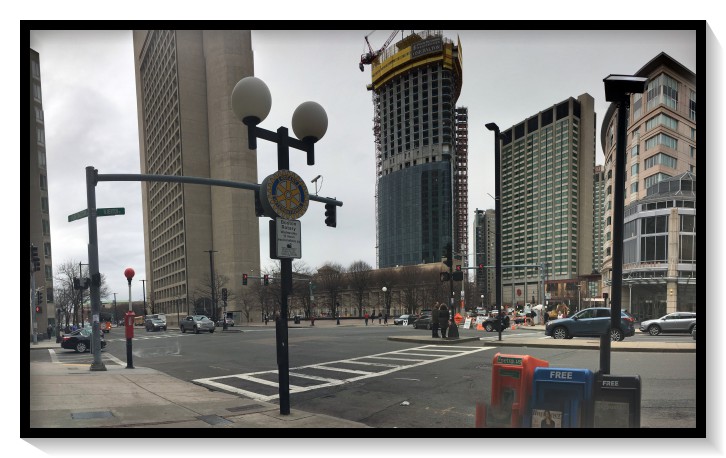

Corner of Huntington Ave and Belvedere Street gets to be really windy at times.

Windiest Location in the City

One of the Windiest spots is at the corner of Huntington Ave and Belvedere Street. On one side of the intersection is the Prudential Shopping Center and the other side is the Christian Science Center Plaza.

The area is very Windy because of the tall buildings and the proximity to the Massachusetts Turnpike.

This is an area where you’ll want to lower your umbrella in a rainstorm. I have seen plenty of broken umbrellas because of the strong winds. Certainly, a good place to test wind resistance umbrellas.

PermalinkCloudwards Data Recovery Review

One of the worst thing that can happen to a computer user is a failed hard drive. It always happens at the worst possible time. Usually at the tail end of writing a term paper or before the big presentation is due.

Recovering from a failed hard drive can be a painful and very expensive experience. There are plenty of places that will offer data recovery but at a very hefty price. Having a good backup plan can make it easy, but unfortunately, it isn't properly planned until well after you experience the computer startup failure.

Finding the Right Solution

The technical team over at Cloudwards.net recently selected Prosoft Engineering Data Rescue as their choice for the best Data Recovery for failed hard drives. They recently wrote up a very detailed review of the software solution and why they selected it as their top pick for consumers and businesses. Data Rescue is available for PC and Mac.

Read all about the Data Recovery Software review on Cloudwards website: https://www.cloudwards.net/prosoft-engineering-data-rescue-review/

At the End of the Day

If you have a computer hard drive that is about 5 years old, you should consider getting a good backup today. My computer crashed earlier this year and it was a hard lesson learned. A good back up, offline or online, would have made starting off 2017 so much easier.

Read the review on Cloudwards.net and find the solution that works with your needs and budget. Get your Data Recovery Software now, because you don't want to be scrambling through Google Searches to overpay for a solution later.

PermalinkHot Toys of 2017

Last Month Toy R Us come out with the Hottest Toys of the Christmas season.

So far here's what I see as the hottest toys of the year:

- LOL Surprise Big Surprise

- LOL Surprise Glitter Ball

- Hatchimals Surprise Twin

- Luva♥Bella

- Pikmu Pops Surprise

- Enchanted Unicorn

- Fingerlings Exclusive Mia baby monkey

Note: It appears that any toy with a "surprise" is going to be a hit. That is you don't know exactly what your getting until you open it.

If any of these are on your children's shopping list, you should start going shopping now! Otherwise, you'll be spending much of December looking for stores that are getting stock.

On eBay you can find sellers that will have all the popular toys starting at $1,200.

I'll update this post as other products become "hot" due to supply and demand.

PermalinkTips For Evaluating Your Business Strategy

Any type and size of business should evaluate its business strategy with regularity. Some businesses benefit from a weekly evaluation while others stay on track with monthly check-ins. Regardless of how often you evaluate your business strategy, do it consistently and don’t get behind.

Investing a little extra time every week or month can help you thrive rather than barely stay afloat. Failing to evaluate with regularity can make it harder to catch and fix an issue before it becomes a big problem for your business.

Consider the following tips for evaluating your business strategy:

Deciding What To Evaluate

Businesses, big and small, always want to (and should) evaluate the financial elements of their strategy. This means you should focus on the sales, profits, cash flows, and the return on investment.

Utilizing online tools such as an ROI Calculator (Return on Investment) can make it easier to see if your marketing plan is a good financial investment for your business. If not, you can reevaluate your current marketing plan and see if you need to consider something else.

Keep in mind that you might not evaluate certain aspects of your business strategy each time, but you should always be evaluating the financial elements of your business.

When You Should Evaluate

Setting up a schedule for evaluating your business strategy is an excellent way to stay on track and often times ahead. As mentioned earlier, you may feel that it’s necessary to take a look at your strategy on a weekly basis (especially when starting out) or once a month is more than enough.

How often you choose, be consistent. It’s important to think about evaluating your strategy when things within the business have changed. For example, once you’ve reached a business goal, it’s time to look at your strategy and work on creating another goal; this is essential to growth.

You may also want to consider more frequent evaluations when your customers change (or need to change) or when competitors force you to change your business plan.

Can You Cut Costs?

Every size of a business should look at ways to make their operation more fiscally responsible. Does this mean you should cut employee hours and positions within the company? No (unless they don’t have a purpose in the company).

When you evaluate your business plan, you will be looking at your daily, weekly, and monthly costs. Maybe you’ve been paying for a marketing service for months but have failed to see any improvement. Maybe a promising advertisement campaign fell short and actually lost you some value customer. Those are costs you can cut or at least should reconsider.

Streamline your costs to reflect your business goals and anything that fosters the growth, not things that keep it stagnant or even lose business. This can be a long and arduous step but if you stick with a regular schedule of evaluating, it shouldn’t be that difficult, and you’re less likely to experience a major financial loss.

PermalinkSelf-driving Cars

If you've been eagerly awaiting the arrival of a self-driving car or have been dreading seeing more on the roads, other than test cars, you will see them sooner than later. There's no specific date for a mass release, but many automakers are confident that we'll see an autonomous car on the road by 2020; you may not be able to own one, though.

Unlike the standard vehicles we know so well, self-driving cars are far more complicated and must be completely road ready before the everyday driver can buy one. Here are some of the reasons that self-driving cars are the car of the future, but why it may take awhile:

Self-Driving Cars Need to Learn How to Be Better Drivers

In order for an autonomous vehicle to be deemed completely road worthy and safe, it should have enough knowledge to handle any kind of situation on the road. Self-driving cars "learn" how to drive by constantly collecting data while on the road.

Remember, self-driving cars are replacing human drivers, so the objective to build a car that is safer than the average driver. Why must a self-driving car be better than the average driver? One of the main reasons behind building a self-driving car is to help eliminate accidents, and most of the accidents are a result of human error.

Gathering data and learning how to be a better and safer driver takes time. You wouldn't want to share the road with a bunch of drivers who haven't had training, would you?

Operating in All Types of Conditions

In addition to learning how to be the safest driver, self-driving cars need to learn how to operate in all kinds of weather and road conditions. Ideally, we would all live in a part of the country where road infrastructure was flawless, lanes were clearly marked, and wintry conditions didn't happen, but we don't; therefore, self-driving cars need to learn how to read the road, regardless.

Don't expect to see a wide release of autonomous cars until they can prove they've passed every safety check.

The Cost

Even if the self-driving car was perfected and ready to be manufactured by every major automaker, depending on the cost, you might never get to own one. Depending on the source, the estimated cost of an autonomous car may be between $75,000 to 250,000; that's pretty prohibitive for the average consumer.

If you consider all of the features that go into making a self-driving car, such as the software and safety technology, the price seems reasonable, relatively speaking.

Bottom Line

The bottom line is that we won't see mass amounts of autonomous cars on the market until they are completely safe and have the ability to operate as if a driver was operating the car. If you think about the rigorous testing that today's standard vehicles must go through, wouldn't you want to know that your self-driving car would be just as safe if not safer?

PermalinkNo Short Cut Sign

At the Copley Mall construction site is this sign:

I don't know who at the construction company thought of it, but it's certainly a different type of motivation sign: "No Shortcuts Keep Your Family in Mind"

Actual sign seen in early 2016.

On June 7th, the Copley Mall entrance is scheduled to reopen. Some interesting information:

- Closed for Construction on March 6, 2016

- Total Construction Days: 458 days ( or 316 calendar days excluding Weekends and Holidays)

- Inial Cost of the Project: $9.2 million

- Number of opening delays: 4 ( Dec 2016, January 2017, March 2017, June 2017)

- Average number of commuters that pass through the doors:

I am glad to see the entrance reopening. Hopefully, the escalator doesn't break down as much as it did before.

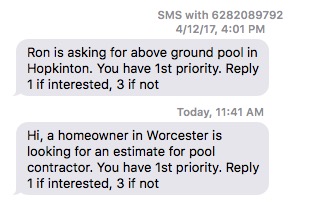

PermalinkMystery Text Messages

Recently I have been getting lots of mystery text messages like these:

- Ron is asking for above ground pool in Hopkinton. You have 1st priority. Reply 1 if interested, 3 if not

- Hi, a homeowner in Brockton is looking for an estimate for the inground pool. You have 1st priority. Reply 1 if interested, 3 if not

- Hi, a homeowner in Tyngsboro wants to get a quote for pool contractor. You have 1st priority. Reply 1 if interested, 3 if not

According to a post in RemoteCentral.com, it turns out the text messages is from gosmith.com.

gosmith.com is a service that matches homeowners with projects with professionals that can handle the project. I am not sure how my phone number go into their database. I think they purchased a cellphone contractor list and just sending out text messages. I certainly wouldn't have signed up for their service, and I never received emails confirming that I am listed as a contractor.

PermalinkAbout

Are you looking for new and innovative ways to improve your business? Look no further! In these blog series, we'll be sharing some interesting tips and tricks that can help take your business to the next level. From marketing strategies to productivity hacks, we've got you covered. So, let's dive in and explore some of the most effective ways to grow and succeed in the world of business.

Check out all the blog posts.

Blog Schedule

| Sunday 27 | Misc |

| Monday 28 | Media |

| Tuesday 29 | QA |

| Wednesday 30 | Pytest |

| Thursday 1 | PlayWright |

| Friday 2 | Macintosh |

| Saturday 3 | Internet Tools |

Other Posts

- 7 Ways to Boost Your Social Media Conversion Rate

- Top 5 Thursday Blog Posts of 2023

- Social Distancing Tip

- Dark Social: Understanding and Harnessing the Power of Private Social Sharing

- Scotch Heavy Duty Shipping Package Tape

- How to Edit video: Guide to Film and Video Editing

- 8 Surprising Things You Did not Know About Christmas Trees

- How to Market a Financial Business Online

- Understanding Factoring Companies

- How to Get the Most Out of Your Social Media Strategy

- Doggie Dooley

- Revolutionize Your Content Strategy

- Conversion Rate Magic The Psychology Behind Effective Website Conversions

- 6 Social Media Monitoring Mistakes Most Businesses Make

- Taking Care of Your Most Valued Business Asset: You!